And because some SDIRAs such as self-directed common IRAs are subject matter to expected least distributions (RMDs), you’ll must strategy ahead making sure that you've got sufficient liquidity to satisfy The principles established by the IRS.

Have the liberty to take a position in Pretty much any type of asset with a possibility profile that matches your investment tactic; such as assets which have the possible for a greater amount of return.

Opening an SDIRA can present you with access to investments Commonly unavailable via a bank or brokerage organization. Right here’s how to start:

The key SDIRA procedures from the IRS that buyers need to have to be familiar with are investment restrictions, disqualified persons, and prohibited transactions. Account holders should abide by SDIRA principles and polices to be able to preserve the tax-advantaged status in their account.

Incorporating income straight to your account. Do not forget that contributions are topic to annual IRA contribution boundaries set via the IRS.

Just before opening an SDIRA, it’s imperative that you weigh the opportunity advantages and disadvantages determined by your distinct financial objectives and threat tolerance.

Indeed, property is among our shoppers’ hottest investments, occasionally identified as a real estate IRA. Customers have the choice to speculate in almost everything from rental properties, business housing, undeveloped land, mortgage loan notes plus much more.

While there are various Added benefits affiliated with an SDIRA, it’s not without its individual drawbacks. A few of the prevalent explanations why buyers don’t pick out SDIRAs include:

Simplicity of use and Technological know-how: A user-welcoming System with on line applications to track your investments, submit documents, and take care of your account is important.

The tax rewards are what make SDIRAs attractive For lots of. An SDIRA is usually both equally classic or Roth - the account variety you end up picking will count mainly with your investment and tax technique. Look at along with your financial advisor or tax advisor when you’re Uncertain that is ideal for you.

Not like stocks and bonds, alternative assets are frequently more difficult to provide or can include demanding contracts and schedules.

Entrust can help you in getting alternative investments blog with the retirement resources, and administer the shopping for and providing of assets that are generally unavailable by way of financial institutions and brokerage firms.

Place simply just, in case you’re searching for a tax economical way to develop a portfolio that’s far more customized towards your interests and abilities, an SDIRA can be The solution.

An SDIRA custodian differs as they have the suitable workers, experience, and capacity to take care of custody from the alternative investments. The initial step in opening a self-directed IRA is to locate a supplier that may be specialised in administering accounts for alternative investments.

Earning quite possibly the most of tax-advantaged accounts allows you to keep more of The cash you make investments and earn. Based on irrespective of whether you select a traditional self-directed IRA or a self-directed Roth IRA, you have the probable for tax-free of charge or tax-deferred progress, delivered selected ailments are met.

Lots of investors are astonished to find out that employing retirement funds to speculate in alternative assets has long been achievable considering that 1974. However, most brokerage firms and banking institutions target supplying publicly traded securities, like shares and bonds, because they deficiency the infrastructure and expertise to manage privately held assets, like real estate property or non-public fairness.

Be accountable for the way you develop your retirement portfolio by utilizing your specialized awareness and passions to invest in assets that healthy with your values. Obtained abilities in property or private fairness? Utilize it to guidance your retirement planning.

For those who’re searching for a ‘set and neglect’ investing technique, an SDIRA probably isn’t the best selection. Because you are in total control about every single investment manufactured, It is really your decision to carry out your own personal research. Bear in mind, SDIRA custodians aren't fiduciaries and can't make recommendations about investments.

Complexity and Accountability: With an SDIRA, you may have much more Regulate more than your investments, but You furthermore mght bear much more accountability.

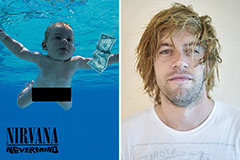

Spencer Elden Then & Now!

Spencer Elden Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!